Modern Finance

for the Culture*

Join 1,000,000+ in the movement.

As Seen on:

As Seen on:

For one and for everyone.

Digital Banking For Us.

- Get a Greenwood Mastercard® debit card

- High Yield savings account that earns 4.15% annually

- No hidden fees, no minimum balance

- Get paid 2 days early

- Overdraft protection

- Apple Pay & Google Pay

- All deposits are FDIC insured

- Global ATM access

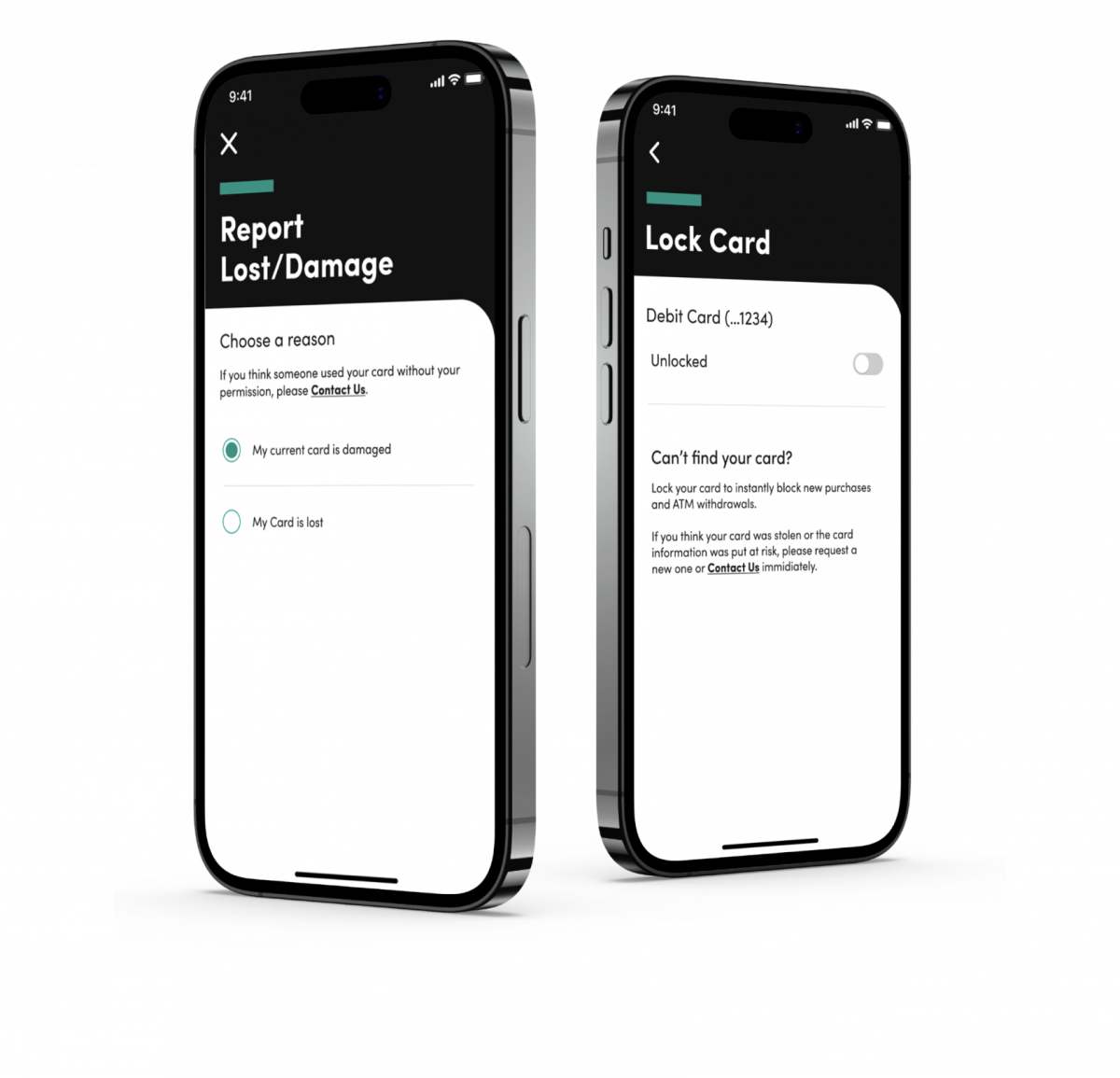

Next-gen security. No worries.

- Turn on instant transaction alerts

- Block your card in one tap

- Secure two-factor and fingerprint authentication

- FDIC insured up to $250K through our partner Coastal Community Bank, Member FDIC

- Price Protection, Identity Theft Protection and Zero Liability for unauthorized transactions

Black-Led. Black-Owned.

Our founders, Michael “Killer Mike” Render, Amb. Andrew Young, and Ryan Glover were inspired by the early 1900’s Greenwood District, where recirculation of Black wealth occurred all day, every day, and Black businesses thrived.

Protect. Grow. Pay it forward.

Your account is FDIC-insured up to $250,000 through Coastal Community Bank, Member FDIC1.

Grow your savings at 4.15% APY5 and invest in over 5,000 stocks and ETFs. Donate with spare change round-up to non-profits like the UNCF and the NAACP2.

Spend, Save & Invest

EARN 4.15% APY

ON SAVINGS

APPLE &

ANDROID PAY

PEER-TO-PEER

TRANSFERS

INSTANT CARD

TRANSFER

COMMUNITY

REINVESTMENT

GLOBAL ATM

NETWORK

NO HIDDEN

FEES

TWO-DAY

EARLY PAY

Invest With Purpose.

Next-Level Lifestyle Perks.

Travel in style with complimentary upgrades, resort credits and more. Plus, rest easy with purchase protection, identity theft protection, and Zero Liability for unauthorized transactions.

Next-gen security. No-worries.

Your money is safe. All deposits will be held at FDIC-insured banks1. Peace of mind. That’s everything.

Spend in the Black Community.

Help support Black-Owned businesses.

Purchase from Black-owned businesses, promoting economic support within the community.

Greenwood Loan Partners

We partner with Black-owned lending companies like Loanspark and Live Oak Bank to promote loan options with competitive rates.

Join Us. Pay it forward.

Donate to Non-Profits

Give to UNCF and NAACP through spare change round-ups.2

Small Business Grants

We gift $10,000 every month to a Black or Latino owned business.

Join the Movement.

After your one month free trial, membership is just $9.99 per month and includes our exclusive Black Mastercard® Debit Card.

Why our customers rated us 4.8 stars in the App Store

1Greenwood is a financial technology company, not an FDIC-insured bank. Banking Services provided by Coastal Community Bank, Member FDIC. FDIC insurance only covers the failure of an FDIC-insured bank. FDIC insurance is available through pass-through insurance at Coastal Community Bank, Member FDIC, if certain conditions have been met. Deposits are insured up to $250,000 per depositor. The Greenwood Debit Card is issued by Coastal Community Bank pursuant to a license by Mastercard® International.

2When you choose to participate in the Greenwood Gives Back Program, you are collectively donating to organizations pre-selected by Greenwood. For every person that opts into the program, we round up the amount of Greenwood Debit Card transactions made using your Greenwood Debit Card feature in your Greenwood Spending Account to the next whole dollar amount (from $0.01 to $0.99), and transfer the amount in excess of the purchase price to a Greenwood Gives Back Service Account. Even dollar transactions ($xx.00) are not considered qualifying transactions and are not eligible to be rounded up for this Service. Greenwood then aggregates all dollars in the Greenwood Gives Back Savings Account and makes one contribution to the non-profit selected in the sign-up period.

3Direct Deposit early availability depends on timing of payor’s payment instructions and fraud prevention restrictions may apply. As such, the availability or timing of early direct deposit may vary from pay period to pay period.

4MasterCard’s Zero Liability Policy covers U.S.-issued cards and does not apply to certain commercial card transactions or any transactions not processed by MasterCard. You must notify Greenwood immediately of any unauthorized use. For specific restrictions, limitations and other details, please consult your issuer

5The Annual Percentage Yield (APY) for savings accounts through Greenwood is variable and is subject to change at any time. The disclosed APY is effective as of May 22, 2023. An account must have $0.01 in savings to earn interest.

6Check deposits received after 5PM ET on a business day (excluding weekends and bank holidays) will be processed the next business day. Funds are generally made available within 4 business days after the deposit is approved. All deposits are subject to review and acceptance is not guaranteed.

To prevent delays in the processing of your check, please check the following:

- Your name [only] should be in the “Pay To The Order Of” field

- Check is drawn on a financial institution in the United States

- Check is dated within the last six (6) months

- Write “For Greenwood Mobile Deposit Only” under your endorsement

7 Out-of-network ATM withdrawal fees apply. Greenwood will charge an ATM Withdrawal Fee of $2.50, in addition to any fees charged by the ATM operator. Please refer to account terms and conditions.

The Elevate membership is $200 per month. Travel, spend and experiences benefits are only available with the Greenwood account and Elevate Debit Card.

Greenwood Investment Advisors Accounts are held at a broker-dealer and qualified custodian DriveWealth, LLC, member SIPC and FINRA. Cash and investments in this account are protected by SIPC up to $500,000, with a limit of $250,000 for cash. For details, please see https://www.sipc.org are held at a broker-dealer and qualified custodian.

Investment advisory services are provided by Greenwood Investment Advisors LLC, an SEC registered investment adviser. Brokerage services are provided by DriveWealth LLC, member FINRA/SIPC.

Investments in securities: Not FDIC Insured – Not Bank Guaranteed – May Lose Value.

All other product names, logos, brands, trademarks, and registered trademarks are property of their respective owners. All company, product, and service names used in this website are for identification purposes only. Use of these names, trademarks, and brands does not imply endorsement.

8 The Annual Percentage Yield (APY) for savings accounts through Greenwood is variable and is subject to change at any time. The disclosed APY is effective as of May 22, 2023. An account must have $0.01 in savings to earn interest.

©2020-2024 Greenwood, Inc.